Welcome to CISP

Contact

Mailing Address

Center for International Services and Programs

2121 Euclid Ave BH 412

Cleveland, OH 44115-2214

Campus Location

Berkman Hall 412

1899 E 22nd St

Cleveland, OH 44115-2214

Phone: 216.687.3910

Fax: 216.687.3965

intlcenter@csuohio.edu

Social Security Number (SSN)

A Social Security number (SSN) is issued to track earnings over a worker's lifetime in the United States. In most cases, you will only be issued one Social Security Number in your lifetime. Students holding F-1 and J-1 status who are employed in the U.S. must apply for a Social Security number if they do not already possess an SSN. Dependents in F-2 status are not eligible for a Social Security number.

Students who will not work on-campus but who will receive a taxable scholarship can apply for an Individual Tax Identification Number [ITIN] for tax purposes.

****As of February 1, 2021 Cleveland State University is an E-Verify employer. All new hires must submit their Social Security number to their hiring manager/CSU payroll office within three weeks of their hiring date.

In order to issue a Social Security number, the Social Security Administration requires evidence that you are eligible to work in the U.S., that you are a full-time student, and that you have received an offer of on-campus employment or have been authorized for off-campus employment through Curricular Practical Training, Optional Practical Training, or Academic Training. A Social Security number is not required to obtain a driver's license, cell phone contract, credit card, insurance policy, admission to an academic institution or other "non-work" reasons including opening a bank account or signing a lease. The Social Security Administration must verify your immigration documents and status with USCIS before issuing a Social Security number. A Social Security number itself is not work permission.

How to Apply :

F-1 Students without a Social Security number (SSN) who have been offered on-campus employment

- Register for full-time credits. "Full-time" is 12 credits for undergraduates and 9 credits for graduate students.

- Update your local address through your CampusNet, even if it is only a temporary address

Print and ask your supervisor/ hiring manager to complete Section I of the

Employment Memo for SSN .

- Return the Letter with Section I completed to the CISP front desk in Berkman Hall 412.

- Allow 10 business days for CISP processing. CISP will verify your full-time status as well as on-campus employment eligibility and will sign the form ( in Section II).

- You will receive an email from CISP when your Employment Verification Letter is ready for pick up in the office. At that time, you will also be given instructions on how to apply.

For F-1 and J-1 students in their first semester at CSU – your CISP International education adviser (DSO) will first need to update your record in the Student and Exchange Visitor Information System (SEVIS) before you attempt to obtain an SSN. Make sure that you use a Form I-20 that says Continuing Attendance as part of your supporting documents. Applicants may apply for an SSN as early as 30 days before an employment start date.

Complete the online SSN application and then schedule an appointment to present your original documents at the local Social Security Administration office. Applications are not complete unless the supporting documents are presented in original, in-person, in a Social Security Administration Office.

1. Complete the online SSN application

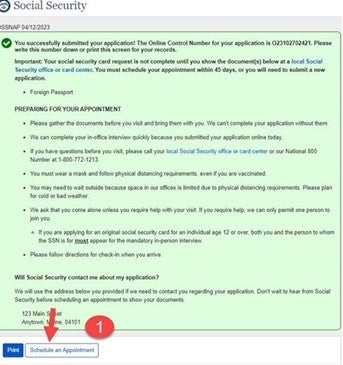

2. Note your application reference number or print out the submission screen page for use during your appointment

3. Schedule an appointment with the SSA Office.

Immediately upon submission of the online application, click the the button to schedule an appointment to present the required original documents in-person (see red arrow in the image).

4. Go to your appointment at the scheduled time, bringing your required documents (in original format):

- Completed and signed CISP Social Security Verification and Employment Form

- Form I-20 (Continuing Attendance I-20, not a transfer pending I-20)

- Valid passport (along with old passport if it contains your F-1 visa)

- Hard copy printout of your electronic I-94 information, which can be obtained at https://i94.cbp.dhs.gov/I94/

- Your online application reference number

F-1 Students Authorized for Curricular Practical Training:

Apply for a Social Security number by following steps 1-3 above. Apply no earlier than 30 days before your scheduled employment start date. Bring with you to your appointment:

- Form I-20 (updated and endorsed for practical training)

- Passport

- Hard copy printout of your most recent I-94, which can be obtained at https://i94.cbp.dhs.gov/I94/

F-1 Students Authorized for Optional Practical Training:

Apply for a Social Security number by following steps 1-3 above. Apply on or after the start date on your EAD card.

Bring with you to your appointment

- Form I-20 (updated and endorsed for practical training)

- Passport

- Hard copy printout of your most recent I-94, which can be obtained at https://i94.cbp.dhs.gov/I94/

- EAD Card

Helpful Websites

Frequently Asked Questions

What does it cost?

There is no charge for a Social Security number application.

How long does it take to get a Social Security number?

The Social Security Administration will mail your card (with the number on it) as soon as all of your immigration information has been verified and your application has been processed. It can take 2-4 weeks or more.

What if my card is lost or stolen?

You can replace your card for free if it is lost or stolen. However, you are limited to three replacement cards in a year and 10 during your lifetime. Legal name changes and other exceptions do not count toward these limits. For example, changes in nonimmigrant status that require card updates may not count toward these limits.

To request a replacement card:

- Complete an online Application For a Replacement Social Security Card

- Present recently issued photo identification to show your identity (passport, state identification card)

- Show evidence of your current lawful nonimmigrant status (visa, I-20/ DS-2019, I-94)

- Complete a new Social Security Verification form (if you are employed on campus) provided by the CISP

- Your replacement card will have the same name and number as your previous card.

What if my immigration status or citizenship changes?

If your immigration status changes or you become a legal permanent resident (LPR), you should inform the Social Security Administration so that your records can be updated. You will need to present documents that prove your new status.

Are my earnings taxable for Social Security purposes?

As a student in F-1 or J-1 status, your earnings from authorized employment are generally not taxable for social security purposes.

Please review the Internal Revenue Service (IRS) Publications 515 and 519 for details about employment taxes payable on the earnings of nonresident aliens.

Can I start working before I receive a Social Security card?

As long as you have authorization (on-campus work, CPT or OPT), yes: you can start to work while your SSN application is still processing. You should ensure your employer follows the correct instructions for allowing you to begin work without the SSN. The Social Security Administration's publication, "Foreign Workers and Social Security Numbers," has additional information.

Can I have more than one SSN in my lifetime?

No, most people will not ever apply for a second SSN except under exceptional circumstances. Each job does not require a new number.

Contact

Mailing Address

Center for International Services and Programs

2121 Euclid Ave BH 412

Cleveland, OH 44115-2214

Campus Location

Berkman Hall 412

1899 E 22nd St

Cleveland, OH 44115-2214

Phone: 216.687.3910

Fax: 216.687.3965

intlcenter@csuohio.edu